Geospatial × ICT

Fixed property taxation support

Taxes on fixed properties account for roughly 40% of the tax revenues of local municipalities. As land prices have fallen because of the prolonged recession and more land-related information is made public, residents’ level of interest in fixed property tax has risen. Meanwhile, taxation authorities must efficiently and accurately identify taxable properties and levy appropriate taxes based on accurate base data. As one method for addressing these issues, Kokusai Kogyo is suggesting a solution that utilizes spatial information technologies.

Securing revenue sources through accurate identification of taxable properties, appropriate valuation, and fair taxation is the main mission of taxation authorities. In order to fulfill the responsibility to explain fair taxation and disclose necessary information, accurate identification of taxable properties and correct assessment data are essential.

Additionally, taxation data such as parcel numbers (property boundary data) and residence maps constitutes one of the spatial data elements that make up the framework of electronic local government, and is also important for other departments besides taxation departments. Utilizing this data to the full extent while addressing local tax laws and personal information protection can help improve administrative operations and reduce cost.

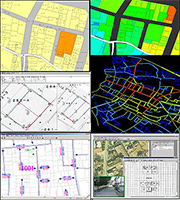

To help tackle the various issues related to taxation operations, which require a massive amount of labor and specialized knowledge, Kokusai Kogyo provides comprehensive services based on its spatial data technologies. Furthermore, with the concept of “integrated GIS” in mind, we aim to actively utilize taxation data while paying the utmost attention to security.

- We accurately identify taxable properties and store them in a database.

- We provide assessment systems and business operation support systems.

- We build data-sharing environments for taxation departments.

- We aim to reduce total administrative costs through sharing of property boundary data and residence data.

- We assist with operations for levying taxes on unassessed (untaxed) properties.

- Collecting omni-directional image data and associating it with positional data allows us to improve the efficiency of fixed property taxation operations even further.